Republicans including J.D. Vance ALREADY being raked over coals for opposing expanded child tax credit vote after Democrats lay election-year trap

Senate Majority Leader Chuck Schumer forced Republicans to go on the record opposing a bill that would expand the child tax credit on Thursday - in a vote they hope will benefit them politically over the next three months.

The $78 billion package would expand the child tax credit and bring back popular research and development business tax deductions. It failed in a procedural vote to begin debate on it.

The package would by 2025 increase the child tax credit from $1,600 to $2,000 and allows families who owe less than that on taxes to get it as a refund - in what Republicans say disincentives work.

It came just ahead of a five-week stint back home for senators, where those who have races in November can use the vote to say Republicans don't support the popular child tax credit.

Schumer admitted to Punchbowl news his Democrats who are up for reelection this year are 'very excited' about the vote, no matter the outcome.

'Our 2024-ers were very excited about having a vote on this bill — win or lose,' Schumer told us. 'They'd rather win, we'd all rather win. But even losing is a benefit.'

Democrats also plan to use it to knock Donald Trump's VP pick J.D. Vance, who has come under fire for his past 'childless cat ladies' comment and often peddles the importance of families.

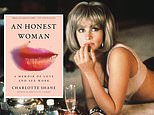

Senate Majority Leader Chuck Schumer forced Republicans to go on the record opposing a bill that would expand the child tax credit on Thursday

Vance is on the campaign trail and missed Thursday's vote. His office could not be reached for comment on how he would have voted.

Democrats have a new favorite insult for comments like this from Vance and other Republicans - 'weird.'

'There's a lot of weird, bizarre stuff going around. Everyone is going to find out on Thursday who's a supporter, particularly of large families,' Wyden said ahead of the vote.

'After viciously attacking women and families and disparaging Americans who don't have children, Vance can't even be bothered to show up to work today to vote on critical legislation to expand the child tax credit to help Americans with children make ends meet,' DNC spokesperson Aida Ross said in a statement before the vote was even finished.

A procedural vote on the bill failed 48 to 44. It needed 60 votes to pass.

Three Republicans -Sens. Josh Hawley, R-Mo., Markwayne Mullin, R-Okla., Rick Scott, R-Fla., broke rank and approved advancement of the bill.

It would also green light families with multiple children to get the credit faster, which would be adjusted each year for inflation.

The child tax credit provision is expected to cost $33 billion in lost revenue, according to the Congressional Budget Office.

It would also businesses to fully expense domestic research and development costs and increases deduction for the purchase of machinery and equipment through 2025.

The legislation would also bring back popular business deductions for research and development. It includes tax benefits for Taiwan- and offsets costs by rolling back payroll tax breaks.

Democrats also plan to use it to knock Donald Trump's VP pick J.D. Vance, who has come under fire for his past 'childless cat ladies' comment and often peddles the importance of families

The deal would also expand the low-income housing tax credit to attract developers to build affordable rental units.

The bill was drawn up in an agreement by House Ways and Means Chairman Jason Smith, R-Mo., and Senate Finance Committee Chairman Ron Wyden, D-Ore. It easily passed the House 357-70.

Wyden said those provisions would benefit 15 million kids from low-income families and help build some 200,000 affordable housing units.

But Senate Republicans are less enthusiastic about the bill. They say they don't oppose expanding the child tax credit outright but have concerns about the cost and insist the legislation needs to be workshopped.

'Today as the Senate prepares to leave town for the August state work period, the Democratic leader has decided to squeeze in one more vote. It isn't ready for prime time,' Republican Leader Mitch McConnell, R-Ky., said Thursday.

Sen. John Cornyn, R-Texas, called it 'designed to fail' legislation, and accused Schumer of delaying voting on the bill so Democrats could go home for recess and knock Republicans for voting against it.

Schumer 'sat on the bill intentionally for six months and waited until the final hour before a five-week recess to bring it to the floor,' Cornyn said.

Some progressives don't believe the bill goes far enough, and oppose the business offsets.

'I'm really frustrated about the tax bill,' Sen. Elizabeth Warren, a Massachusetts Democrat, told reporters on Wednesday. 'The Republicans have said the terms on which they're willing to hold children is only if every dollar that goes to kids has to be matched by at least $3 for corporations. Those are not our values and those are not the folks who need help.'