Travel agency industry - statistics & facts

The biggest players in the online travel agency market

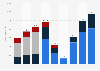

Owner of Booking.com, the most visited travel website worldwide, Booking Holdings is one of the undisputed leaders of the online travel market. In 2024, Booking Holdings’ revenue peaked at almost 24 billion U.S. dollars, surpassing one of the firm’s biggest competitors, Expedia Group, by 10 billion U.S. dollars.While Expedia Group ranks just behind Booking Holdings in a list of the biggest online travel agencies worldwide based on revenue, it was Airbnb that reported the second-highest market cap of leading online travel companies in 2025, ahead of Trip.com Group. Meanwhile, Airbnb also has one of the lowest marketing to revenue ratios in the OTA market, showing that it is less reliant on marketing than its competitors to generate sales.

What is the current state of the travel agency and tour operator market?

Despite having lost ground to OTAs, brick-and-mortar shops are still relevant in the market, with consumers often preferring to rely on travel agents when in need of an expert’s opinion. This is particularly true for the cruise industry, where bookings could be more complex. When looking at the sales channels of the global cruise industry, offline channels generated over three-quarters of that market’s revenue in 2024.Although the combined market cap of leading travel agencies and tour operators worldwide is a fraction of the aggregated market cap of the largest OTAs, there is no lack of big companies in this market, including the likes of travel giant TUI AG and Flight Centre. In 2024, TUI AG’s revenue exceeded 23 billion U.S. dollars – just slightly below the figure of Booking Holdings that year and the highest result reported by the company to date.