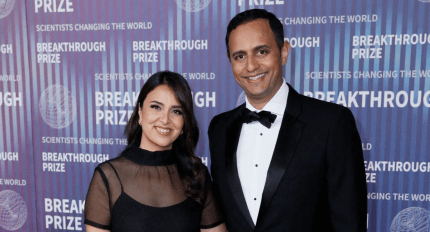

Jaclyn Johnson and Angeline Vuong were on a hike deliberating how hard it can be for people to get started in angel investing when they realized they had stumbled upon a startup idea.

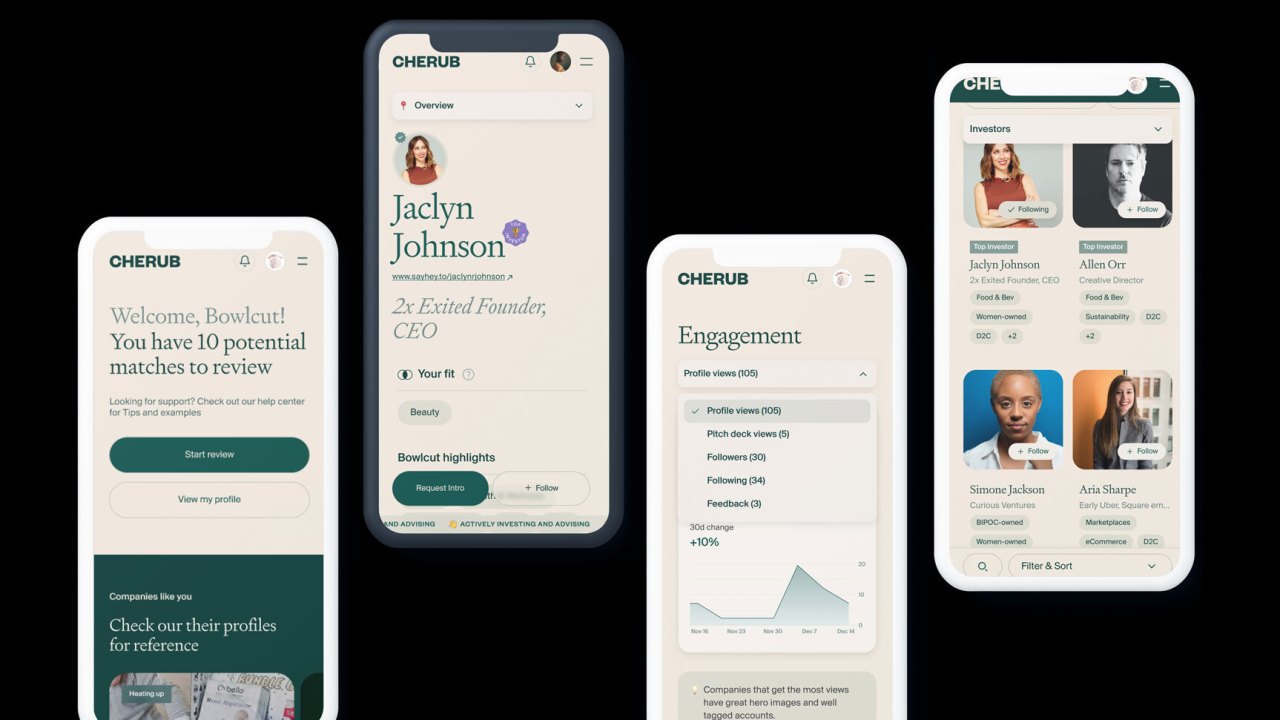

Today they are the co-founders of Cherub, a marketplace that pairs angel investors with entrepreneurs.

Vuong spent nearly five years working in product and growth at Opendoor. Johnson founded Create & Cultivate, a self-described “media company for ambitious women” and had experienced both sides of the investing world — as a founder and an investor. Before starting Create & Cultivate, Johnson sold her own startup (No Subject) in 2016 and invested in numerous companies, including luggage company Away.

Johnson likens Los Angeles-based Cherub to Raya, an online membership-based community for dating, in that it matches founders and angel investors based on their preferences.

“You can go to this platform as an entrepreneur and you can go on the platform as an angel investor and get access to both people and express interest based on tags,” she said in an interview with TechCrunch. “So for instance, if I go on the app and I’m interested in women-owned businesses in the CPG space doing their Series A or something specific, I’ll get surface deal flow that is the highest match to what I’m looking for.”

With Cherub, investors and entrepreneurs can see who is interested in them on the back end. If they too are interested, they can indicate it as such and it’s a match. Conversely, if an investor approaches a founder but that founder doesn’t view them as a potential fit, they can reject the invitation to connect. Or if an entrepreneur’s minimum investment is $25,000 but an angel investor is only investing $10,000 per deal, they can see that and not reach out to connect.

“We’re sort of using dating app mechanics in a way,” Johnson said. “So we jokingly call it the Raya for deal flow.”

Membership-based

To test the concept for Cherub, Johnson and Voung last year first started a weekly newsletter that got 1,500 sign-ups within three weeks on word of mouth alone.

Encouraged, the pair built out an alpha product last summer that featured about 40 companies and gave investors a way to request a deck. All 40 got requests for deck views, Johnson said. Half of those deck views resulted in an introduction, she said, where investors expressed that they were interested in being pitched by the founder. Twenty percent of those introductions ended up getting funded in less than three months, collectively raising $1.1 million in capital.

Of those deals, 40% were new angel investors, meaning they were accredited investors that had never written checks before.

Cherub is now in the process of a slow launch, with 100 startups on the platform generating revenue of $50,000. They plan to grow that to 500, and have a waitlist of 1,500 startups, Johnson said.

Cherub is free for investors to use and charges startups via a membership model. A $480/year membership lets founders list their companies in the directory and includes analytics such as how many people viewed their deck. The Cherub Select membership costs $950 a year and involves a more vetted process to show the company more actively to investors, Johnson said.

Johnson said that Cherub also helps founders find incubators and accelerators and has partnerships with the associated incubators of firms such as Andreessen Horowitz, Dream Ventures and New York Fashion Tech Lab.

Investors also get access to data such as “updates on how a company is performing, whether they’re raising or not and how much,” Johnson said.

Of course Cherub is not the only platform teaming up angels with entrepreneurs. AngelList is the biggest and best known. Israeli crowdsourcing firm OurCrowd is also huge, and then there are the ones offered by venture firms, like Hustle Squad’s Angel Squad for accredited investors, or others like Jason Calacanis’ The Syndicate.

But Cherub is different in a number of ways, Johnson says. For one, it features startups with an emphasis on consumer packaged goods (CPG) companies. Though it also includes AI companies, hotel projects and apps, among others.

AngelList is more of a B2B platform, is very tech industry centric and is best for those who already have knowledge or experience in startup investing and can afford to invest fairly sizable amounts, in Johnson’s view.

Then there’s crowdsourcing Wefunder or Republic, which will allow investors to invest tiny amounts, sometimes as little as $100, which Johnson describes as “the kickstarter of angel investing.”

Cherub sits in the middle, she says. For instance, like traditional VC firms, the company hosts “founder-funder mixers.” Last year, for example, Cherub teamed up with Sophia Amoruso’s Trust Fund to host a cocktail party at which “every single thing on site was investable,” such as the drinks being served and featuring a pop-up shop where guests could “shop any products that they want to test drive.”

“From that event alone, over $400,000 in deals were generated,” Johnson said.

Angel investor Allen Orr told TechCrunch that he had used other platforms such as AngelList in the past.

“However, I felt that it was not a very personal experience and felt too transactional,” he told TechCrunch via email. “What appealed to me about Cherub was the idea of a tailored and social approach to investing,” he said, adding “I also liked that there are opportunities not just for investment but also advising brands.”

Maggie Rose Macar, founder and CEO of mental health support app Zant, said an investor wrote a $25,000 check into her company after it was featured in one of the earliest versions of Cherub’s newsletters and after she met the investor in person at one of Cherub’s events.

“I think Cherub does a great job at bringing active investors into the room with founders who are looking,” she told TechCrunch.

Cherub has raised $1.25 million of its own, naturally from angels, including Drybar’s Alli Webb and Blavity’s Morgan DeBaun, among others.

Comment