100% found this document useful (3 votes)

2K views1 pageNew Excise Form

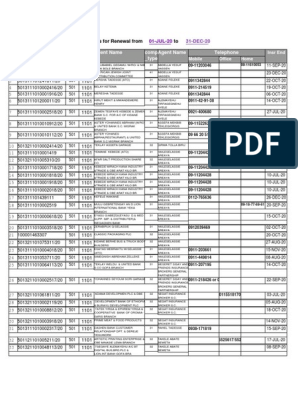

This document is an excise tax declaration form from the Oromia Bureau of Revenues in Ethiopia. [1] It requests information from taxpayers such as company name, taxpayer ID number, tax period, and contact details. [2] There are sections to calculate tax due based on monthly production quantities and unit costs of products in different categories, as well as a section to total the cost of production and excise tax payable for the tax period. [3] The taxpayer or authorized officer must certify the form with their signature and date.

Uploaded by

Abdi Mucee TubeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

100% found this document useful (3 votes)

2K views1 pageNew Excise Form

This document is an excise tax declaration form from the Oromia Bureau of Revenues in Ethiopia. [1] It requests information from taxpayers such as company name, taxpayer ID number, tax period, and contact details. [2] There are sections to calculate tax due based on monthly production quantities and unit costs of products in different categories, as well as a section to total the cost of production and excise tax payable for the tax period. [3] The taxpayer or authorized officer must certify the form with their signature and date.

Uploaded by

Abdi Mucee TubeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

/ 1