What do you think?

Rate this book

368 pages, Kindle Edition

First published January 1, 2005

The Tampa Florida real estate market is thriving with opportunities for savvy investors looking to capitalize on everything from fix and flip projects to long-term rental properties. However, timing is everything—and when deals move fast, traditional bank financing often can’t keep up. This is where Hard Money Loans in Tampa Florida step in to offer a strategic edge.

These short-term asset-based loans allow investors to secure funding quickly with fewer restrictions, enabling them to act decisively in a competitive landscape. By leveraging hard money loans, real estate entrepreneurs in Tampa can access capital with greater speed and flexibility than conventional lending solutions allow.

Private money lenders in Tampa

Real estate investment loans in Florida

Hard Money Loans in Tampa Florida

Hard money loans are primarily offered by private lenders and are based on the value of the property rather than the borrower’s credit history or income. This approach allows investors to close deals within days, not weeks, making these loans ideal for time-sensitive opportunities.

Whereas traditional banks require extensive documentation and high credit scores, hard money lenders focus more on the property's current or after-repair value. For investors looking to flip a house or purchase a distressed property, this can mean the difference between closing the deal or missing out altogether.

Tampa is one of Florida’s most active and promising real estate markets. With steady population growth, economic development, and demand for both rentals and owner-occupied homes, the need for fast access to financing has never been greater.

Hard Money Loans in Tampa Florida provide several advantages, including:

This makes them particularly attractive to investors working on tight timelines or purchasing unconventional properties.

Investors use hard money loans in a variety of scenarios. These include:

Whether you’re flipping a property for profit or planning to convert a home into a rental, hard money loans allow you to move quickly and capitalize on your investment plan.

The approval process for a hard money loan is straightforward. After evaluating the property's value and your investment plan, the lender will make a loan offer, typically for 60 to 75 percent of the property's after-repair value (ARV). Funds can be delivered within days, allowing for immediate purchase or renovation.

Repayment is usually interest-only with a balloon payment at the end of the loan term, which is commonly between 6 and 24 months. Most investors refinance or sell the property before the term ends.

Tampa-based hard money lenders understand the nuances of the local market and can offer terms specifically tailored to Florida properties. From closing timelines to rehab funding and property type preferences, local knowledge plays a vital role in getting the right deal done.

Moreover, lenders who are familiar with Tampa’s neighborhoods, property values, and permitting processes can streamline the approval process and reduce unnecessary delays.

Experienced investors know the value of relationships. Establishing connections with reputable private money lenders in Tampa gives you the inside track to faster approvals better terms and the ability to scale your investments over time.

Private money lenders offer more flexibility than banks and are often open to funding unconventional projects or properties that require extensive repairs. Whether you’re looking to fund your first flip or expand a growing portfolio, local private lenders can provide the financing and support to make your vision a reality.

Beyond Tampa, the demand for real estate investment loans in Florida is growing statewide. Cities like Orlando Jacksonville and Miami are experiencing similar surges in real estate activity. Florida’s favorable tax climate warm weather and influx of new residents continue to drive demand for both primary residences and investment properties.

By leveraging the flexibility of hard money loans investors throughout Florida are capitalizing on opportunities that might otherwise be out of reach due to the limitations of traditional lending.

One of the most popular uses of hard money loans is Fix and Flip Financing. These short-term loans are tailored specifically for investors who buy properties in need of renovation with the intention to sell quickly for a profit.

The key benefits include:

In a city like Tampa where older homes are abundant and property values are steadily rising fix and flip opportunities are everywhere. With the right financing in place investors can unlock value add improvements and turn properties over in months.

Investors focused on long-term wealth appreciate working with the Best Hard Money Lenders for Rental Properties in Tampa. These lenders often offer programs that bridge the gap between short-term funding and long-term refinancing.

They provide solutions such as:

For landlords aiming to buy rehab and hold, having access to this type of capital means being able to grow their portfolios without the delays and constraints of bank underwriting.

The Florida real estate scene demands agility. Short Term Real Estate Financing in Florida offers an advantage for investors who spot deals but need immediate capital to act. Whether it’s a foreclosure auction a wholesale deal or a time-sensitive property acquisition these loans provide the bridge to seize the opportunity.

Short-term loans can be tailored for:

These loans allow investors to operate with the flexibility required in a rapidly changing market.

Finally for the investor who needs to close immediately Fast Approval Real Estate Loans Tampa FL offer the solution. These loans prioritize speed and are perfect for competitive bidding scenarios where a quick close is the only way to win the deal.

Benefits include:

With fast approvals you can secure deals confidently even in high-demand neighborhoods.

Real estate investing is all about opportunity and timing. When the perfect deal comes along the last thing you want is to miss it because your financing isn’t ready. That’s where Hard Money Loans in Tampa Florida come into play. Whether you’re flipping houses acquiring rentals or bridging a financing gap hard money loans provide the fast flexible funding needed to make it happen.

By working with local professionals including Private Money Lenders in Tampa Real Estate Investment Loans in Florida Tampa Fix and Flip Financing Best Hard Money Lenders for Rental Properties in Tampa Short Term Real Estate Financing in Florida and Fast Approval Real Estate Loans Tampa FL you can scale your investments and thrive in one of Florida’s most exciting real estate markets.

Tampa offers strong returns and long-term potential—and with the right financing, your investment success is just one deal away.

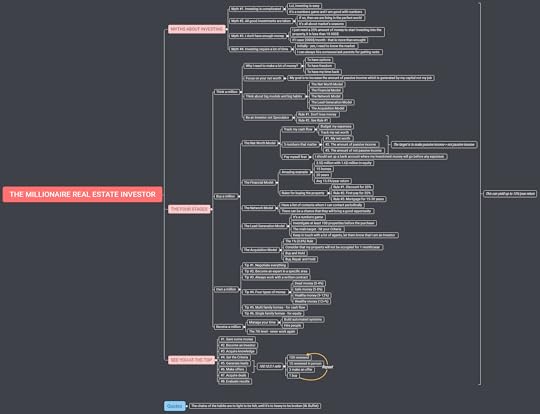

⁃ “if you look to the very best people in a field and study what they do, you often can repeat their success.”

⁃ “Instead of forgetting your dreams and living within your means, try pursuing the means to live your dreams.”

⁃ “It takes patience and perseverance, but you can make it big on little deals. You’re not going to get rich overnight, but you will slowly.”

⁃ “Trammell Crow, one of the most successful real estate investors ever, once famously declared, “The way to wealth is debt.”

⁃ “Where else are you going to make a small down payment, let somebody else pay for it, and you reap all the rewards? I can’t find anything that beats that.”

⁃ “I bought a house in an owner-financed deal for $120,000. I only had to put $10,000 down, and then I put $10,000 into the house to remodel it. I ended up selling for $189,000. So in 58 days, I made $40,000.”

⁃ “The 1031 exchanges give you a choice at the moment of sale either to realize the gain and pay taxes on it or to reinvest that gain in another property and defer the taxes. And when you choose to reinvest, the transaction is treated as if you simply exchanged equity in one property for equity in another.”

⁃ Don’t talk badly about anyone

⁃ “The advice boiled down to calling on industry professionals and asking them two questions:

⁃ 1. “Who do you know that I should know?”

⁃ 2. “What would you do if you were me?”

⁃ ” If the suggestion someone gave me sounded halfway decent, I followed it. Then I went back and asked, “I did it, and here’s what happened. What would you suggest I do next?” Anyone who was willing to be in my Inner Circle would warm up to this, give me additional suggestions, and over time, if I wanted, begin to mentor me.”

⁃ “Typically the more expensive the house, the worse rental deal it makes. There’s probably exceptions to that, but as a rule, as you get into a higher- priced home, the prices go up faster than the rental value of that house.”

⁃ “a general rule is that the more repairs a property requires, the greater the discount is. Major cosmetic repairs such as updating kitchens, bathrooms, and appliances can net investors big returns if they are willing to tackle them. Structural repairs such as fixing a bad foundation bring the biggest discounts but also entail risk.”

⁃ It’s better to miss a good deal on a house than buy a bad one

⁃ Timing matters - be the first or the last person to make an offer

⁃ It’s a numbers game

⁃ “The strong desire to do a deal, to get in the game, can lead to trouble. Never compromise.”

⁃ “It’s a lot easier to get into a deal than to get out of one.”

⁃ The same goes with auctions, either be first or wait until the countdown begins to start bidding

⁃ “The Carrying Costs subworksheet is where you’ll estimate the taxes, fees, utilities, debt service, and upkeep you’ll have to pay for from the time you buy the property to the time you sell it. Remember that these are all time-based estimates. ”

⁃ “Knowing which improvements, at what cost, will bring the Maximum Return is the ultimate skill in this game. It’s the game of getting the highest return from the least investment in improvements.”

⁃ “In general, shorter terms on your mortgage loans will lead to higher monthly loan payments that have a direct negative impact on your Cash Flow but a major positive impact on your Equity Buildup. ”

⁃ “the three biggest expenses are property taxes, insurance, and vacancy.”

⁃ “The bottom line is that if you do your homework, you too can be a ‘genius.’ It’s just not that difficult.”

⁃ “Mistakes are okay; in fact, they are great teachers. Don’t fear them; embrace them.”

⁃ “When you find an opportunity that looks good, always think about quickly getting it under contract. The contract gives you control and will always have clauses that allow you to exit the deal if your due diligence (inspections, conveyances, zoning research, etc.) shows that you need to get out.”

⁃ “The key is to find out what is important to the sellers. Offer them what they want and then ask for what you want. If it doesn’t work, it doesn’t work. Find out what will. Great negotiators are great investigators. They know that every transaction needs to be a win-win.”

⁃ “The longer you can tie up the property for little or no money before you actually have to buy it, the more flexibility you’ll have.”

⁃ Types of repairs

⁃ “1. Improvements that are necessary and add value, such as a new roof or flooring

⁃ 2. Improvements that are unnecessary but add value, such as landscaping and cosmetic enhancements

⁃ 3. Improvements that are necessary but don’t add value, such as plumbing repair, rewiring to code, and foundation work

⁃ 4. Improvements that are unnecessary and don’t add value, such as adding expensive fixtures or amenities”

⁃ “1. Make associating with talent your number one priority.

⁃ 2. Top-grade for ever-increasing leverage.

⁃ 3. Always work from written proposals and contracts.

⁃ 4. Protect your reputation and operate with confidence.”

⁃ Anticipate needs

⁃ For 1031 exchanges: “After the sale of your “relinquished property” you have 45 days to identify the “replacement property” and a total of 180 days to close on that second property.”

⁃ “you may find that it saves you money to pay for the advice of these professionals and then file your own tax returns with the IRS or record the minutes of the investment business meetings you keep for your legal entities.”

⁃ “The indispensable first step to getting the things you want out of life is this: decide what you want.”

⁃ “When something breaks, always think “repair” first, “used” second, and “new” last. Your goal is to avoid non-asset-based debt at all costs. But in the end, if you must incur debt, try to make sure that the debt term and asset longevity match up.”

⁃ “The real key to freedom here lies in putting your payments on a fast path to owning your home free and clear. (Some might disagree with this advice, but as a real estate professional who has seen both sides of this argument, I say do it. Two extra payments a year on a 30-year mortgage pays off your home in 20 years! Do the math.)”

⁃ “he soon learned that apartment complexes had other advantages.

⁃ “I’ve got one roof, one heater, and one on-site manager taking care of everything, instead of 20 single-family homes with 20 roofs and 20 heaters and a full-time maintenance guy running all over the place to take care of them,”

⁃

⁃ “The worst thing you can do is learn continually without putting some of it into practice,”

⁃

⁃ “Usually the biggest critics are people who aren’t investors but are quick to say, “Tenants are a pain” or to make ominous predictions that you’ll “lose your shirt.”

⁃ Keeping other people’s fears from infecting your drive to invest can be a challenge.”

⁃ “There’s a million ways to make a million dollars in real estate investing. Start by picking one.”

⁃ “Once I find something I enjoy, I pour everything into it and master it,”

⁃ “It showed me that when you are on the right path, money will show up,” he says. “And the right path is the spiritual path. The spiritual path is helping people.”

⁃ “if you’re basing your rents on some formula attached to the value of your house, you’ll see your tenants walking out the door.”

⁃ “what you spend on roof repairs, HVAC servicing, and lawn maintenance will make all the difference in the long term.”

⁃ “Establish relationships with lenders long before you need them,” she says. “The time to start courting banks is not when the time bomb is ticking away on a contract that has to close in two weeks.”

⁃ “Harrington believes it’s best to buy when rates are high because that’s when prices most accurately reflect the true value of a property.”

⁃ “it’s pretty easy once you focus on doing it.”

⁃ “finding a good deal is a matter of negotiation and figuring out where everyone’s willing to sacrifice.”