Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Back in 1966, the Headmaster of a Surrey prep school told a young Richard Branson that he’d “either end up in prison or become a millionaire.” He was technically wrong on both counts, since the underachieving teen would eventually become a billionaire. Branson founded one of his most successful ventures when he was just 33—a transatlantic airline called Virgin Atlantic. You probably noticed it as one of the potential transfer partners for your travel rewards card.

So should you place more faith in Sir Branson than his former Headmaster? Is it worth transferring your points to Virgin? In a word: yes, but with major caveats to consider. Let’s dive in.

What is Virgin?

Virgin Atlantic is part of the comically-expansive Virgin Group of companies founded by Sir Richard Branson. Other Virgin Group entities include Virgin Hotels, Virgin Cruises, Virgin Money, Virgin StartUp, Virgin Records and Virgin Wine. Virgin’s over-arching loyalty program is called Virgin Red, and Virgin Atlantic’s Flying Club is a sister to that. Points transfer seamlessly between the two programs as we’ll detail below.

Virgin Atlantic claims to be Britain’s second largest airline, though I’m not sure how they came up with what metric. The long-haul-focused airline has just 42 aircraft in service, compared to British Airways’ 280+ and easyJet’s 320+.

Needless to say, it’s actually more of a niche, luxury airline that specializes in transatlantic flights. You’ll find direct routes from London Heathrow to New York, Orlando, the Caribbean, Delhi and Johannesburg and many more. The brand also formed a joint venture with Delta and Air France-KLM in 2019 to greatly expand its overall network.

Like its wacky founder, Virgin Atlantic has always sought to be “cheekier” than its contemporaries. Think “Southwest Airlines after a couple of pints at the pub,” and you’ll get an idea of their corporate culture. Past marketing campaigns have included phrases like “BA [British Airways] doesn’t give a shiatsu,” and its first seatback games came with the tagline “play with yourself.”

If that sounds a little edgy for modern audiences, consider that the airline once called its inflight entertainment screens “nine inches of pure pleasure.”

One might say we could’ve seen this black belt-level of cheekiness coming down main street when Sir Branson showed up to the airport dressed like a pirate:

But even pirates value loyalty, so let’s talk about Virgin’s rewards program next.

How do Virgin Atlantic Flying Club and Virgin Red work?

To preface, Virgin Atlantic has two loyalty programs (sort of):

- Flying Club is the rewards program exclusive to Virgin Atlantic, where you can earn Virgin Points by flying with Virgin and its partner airlines.

- Virgin Red is the Virgin Group’s greater rewards program, where you can earn and spend the same Virgin Points within the group’s various individual companies (e.g. Virgin Wine) and its 150+ hotel and retail partners.

When you sign up for Virgin Atlantic Flying Club, you’ll be immediately prompted to create a Virgin Red account to store all of your Virgin Points.

Once you have both accounts, points you earn with each will flow into one big pool. They never expire, either, which is a nice touch if you only plan to fly Virgin Atlantic once every few years.

There are seven main ways to earn Virgin Points:

- Flights with Virgin Atlantic or one of its 27 airline partners, including Delta and the rest of SkyTeam.

- Hotels including Marriott, Hyatt, IHG, Best Western and more listed here.

- Rental cars with Hertz.

- The Virgin Atlantic Credit Card

- Shopping with 150+ retail partners.

- Virgin Atlantic Holidays aka vacation packages.

You can then spend your hard-earned Virgin Points with a similar list of options (e.g. flights, retail therapy, hotels, cruises etc.).

Like most travelers, you’re probably going to save your Virgin Points for flights. Good call, given you can redeem Virgin Points with 28 total airlines including Delta, Air France-KLM, Korean Air and more.

One thing to know going in, however, is that Virgin Atlantic takes a similar approach to reward flights as its rival, British Airways. Meaning, you can’t just book any ol’ seat with points.

Instead, when a flight goes on sale, Virgin Atlantic only puts aside a select number of seats (minimum 8 Economy, 2 Premium, 2 Upper Class) that are bookable using Virgin Points. Once they sell out, you can still use points to help, but you can’t fully cover your cost. Virgin calls this “Points Plus Money.”

Have a look at the pricing chart for a flight from Atlanta to London and you’ll see what I mean – the price is 25,000 Virgin Points… plus $537 cash.

Even though your Virgin Points may not cover most (or even half) of your total fare, they might still be valuable enough to consider a transfer.

Is it worth transferring your credit card reward points to Virgin?

To find out, we need to cover which credit cards can actually transfer points to Virgin in the first place. Then, we’ll look at how much Virgin points are actually worth in terms of real-world cash value (1 cent per point? 2?).

Finally, I’ll share tips on how to find deals and “sweet spots” with Virgin Atlantic. Because if you can find a deal that suits your plans, a transfer may instantly become worth it.

Which credit cards transfer to Virgin Atlantic?

To preface, just because a particular card issuer lists Virgin Atlantic Flying Club or Virgin Red as a transfer partner doesn’t mean that all of its individual credit cards have that ability.

Amex, for example, has an impressive list of 21 total transfer partners – but only select cards generate Membership Rewards Points that can be transferred in the first place (by contrast, the Blue Cash Everyday® Card from American Express generates cash back – no points).

That’s why I thought it would be more helpful to list out the specific cards – not just the card issuers – that play ball with Virgin. In each case, credit card points transfer 1:1 toVirgin Red or Flying Club unless otherwise stated.

American Express

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card

- Amex EveryDay® Credit Card

- Amex EveryDay® Preferred Credit Card

To view rates and fees of the Blue Cash Everyday® Card from American Express, see this page.

To view rates and fees of The Platinum Card® from American Express, see this page.

To view rates and fees of the American Express® Gold Card, see this page.

All information about the American Express® Green Card from American Express has been collected independently by Fortune Recommends™.

All information about the Amex EveryDay® Credit Card has been collected independently by Fortune Recommends™.

All information about the Amex EveryDay® Preferred Credit Card has been collected independently by Fortune Recommends™.

The Platinum Card® from American Express

Intro bonus

Earn 80,000 Membership Rewards® Points after spending $8,000 on purchases on the Card in your first 6 months of card membership| Annual Fee | $695 |

| Purchase APR | See Pay Over Time APR |

| Foreign Transaction Fee | None |

at Bankrate

Reward Rates

- 5XEarn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (up to $500,000 on these purchases per calendar year)

- 5XEarn 5x Membership Rewards® Points on prepaid hotels booked with American Express Travel

- 1XEarn 1x points on other eligible purchases

Other benefits

- Travel benefits including hotel and car rental chain statuses, car rental insurance, trip cancellation/interruption and travel delay protection

- Consumer protections including extended warranty and return protection

at Bankrate

Bilt Rewards

Bilt Mastercard®

Special feature

The Bilt Mastercard offers the unique ability to earn points on rent.| Annual fee | $0 |

| Regular APR | See Terms |

at Bilt

Rewards Rates

- Make at least 5 transactions in a statement period, in order to earn points on rent and qualifying net purchases (purchases minus returns /credits) for that statement period.

- 3X3X Bilt Points on dining

- 2X2X Bilt Points on flights, hotels, rental cars, and cruises when booked directly with airlines, hotels, and car rental agencies

- 1X1X Bilt Points on rent paid through the Bilt App with your card account up to a maximum of 100,000 points each calendar year

- 1X1X Bilt Points on purchases

- Rewards and benefits terms.

- Travel perks: Trip Cancellation and Interruption Protection, Trip Delay Reimbursement, Auto Rental Collision Damage Waiver. See this page for details.

- Foreign Transaction Fee: None

at Bilt

Chase

Ink Business Preferred® Credit Card

Intro bonus

Earn 90k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase Travel℠| Annual fee | $95 |

| Regular APR | 21.24%–26.24% variable |

at Cardratings.com

Rewards Rates

- 3x3x points for $1 (up to $150,000 combined) spent on purchases like shipping purchases, internet, cable, phone, and advertising

- 1x1x point per $1 spent on all other purchases

- 5x5x points on Lyft rides through March 31, 2025

-

- Additional perks: Free employee cards, trip cancelation/interruption insurance, auto rental collision damage waiver, cell phone coverage

-

- Foreign transaction fee: None

at Cardratings.com

Capital One

- Capital One VentureOne Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Capital One Venture Rewards Credit Card

Capital One Venture Rewards Credit Card

Intro Bonus

Earn 75,000 miles once you spend $4,000 on purchases within 3 months from account opening.| Annual fee | $95 |

| Regular APR | 19.99%–29.99% variable |

at Cardratings.com

Reward Rates

- 5xEarn 5x miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- 2x Earn 2x miles on every purchase

- The Venture offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment

at Cardratings.com

Citi

Amex, Bilt and Chase have all run transfer bonuses for Flying Club in the past. Bilt ran a 75% bonus on January 1st, 2024 and Chase ran one from May 1 through June 15th 2024 which gave an extra 30%. So you may want to have a quick look at your current or upcoming transfer promos before sending your points to Virgin.

What are Virgin Atlantic Flying Club points (aka Virgin Points) worth?

Credit card nerds tend to agree that Virgin Points points are conservatively worth about 1.2 cent per point (cpp) each when redeemed for flights.

That means they’re worth more than vanilla Capital One miles (1 cpp) and Amex Membership Rewards Points (1 cpp) when redeemed through their respective travel portals, but not as much as Chase Ultimate Rewards® Points redeemed through Chase Travel℠ (1.25 cpp with the Chase Sapphire Preferred, 1.50 cpp with the Sapphire Reserve).

However, some Virgin Atlantic fans report that if you can find the right deal at the right time, you can squeeze nearly double the value out of them and get well over 2 cpp each.

So how do you find the right deal before you transfer your points?

How to find deals and sweet spots on Virgin Atlantic

Thankfully, Pirate Richard makes it easy to find deals on his airline.

A great place to start is on the main Virgin Atlantic page, where you can scroll down to find “our hottest flight deals.”

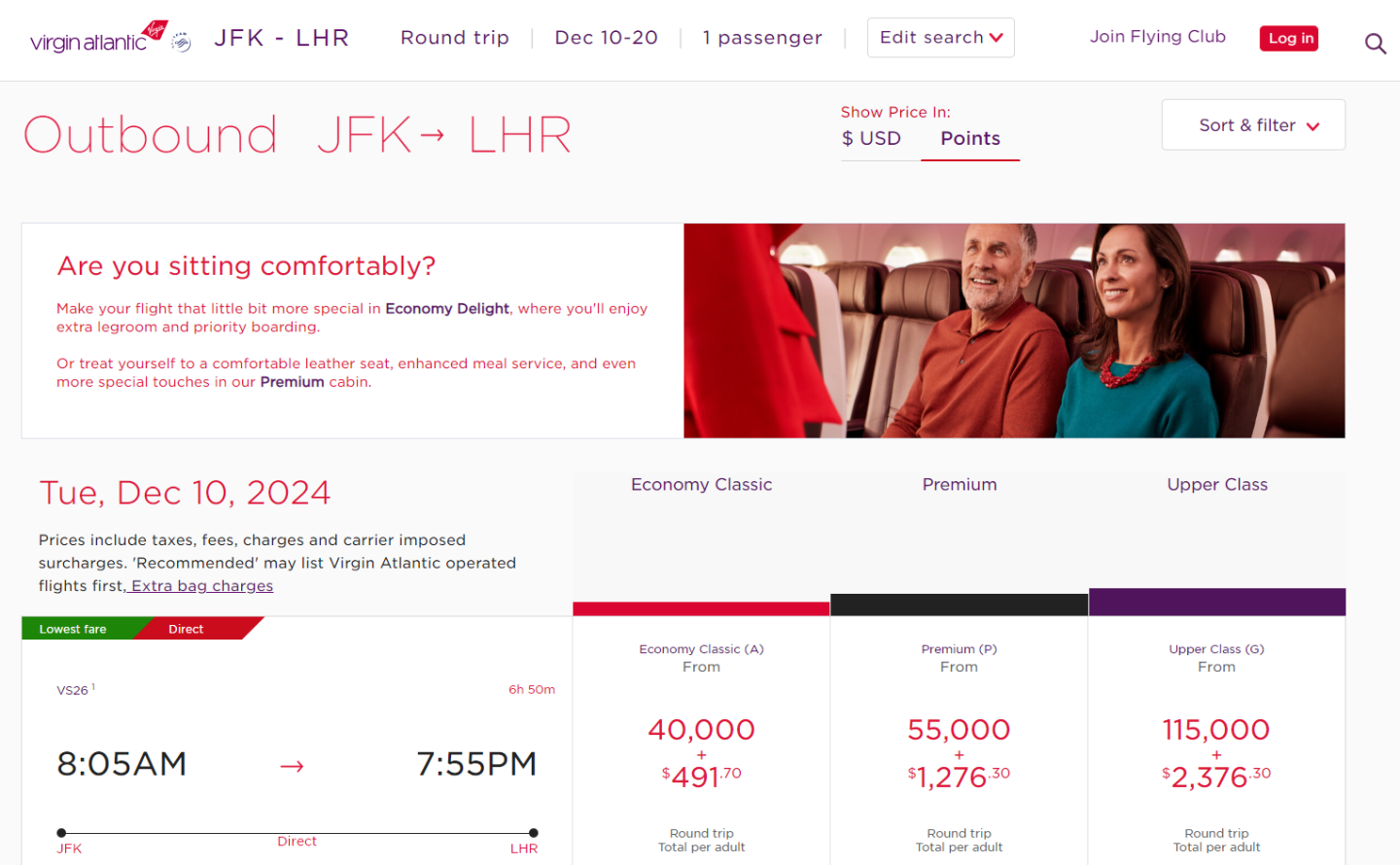

You won’t see the cost in points right away, but you can click a deal, toggle the Points option, and see the results on the actual booking page:

Funny enough, the Virgin Atlantic community says that the “sweet spot” for Virgin Atlantic deals isn’t on Virgin Atlantic at all.

“Biz class flights to mainland Europe flying via Air France or KLM are a sweet spot for Virgin that doesn’t require much effort to find.” said a user in thesubreddit r/AwardTravel. “You might just need to be flexible with dates.”

Many others said that thanks to Virgin Atlantic’s new partnership, you can find plenty of redemption deals on domestic Delta flights. To their point, the official Delta rewards chart shows potential for some very, very cheap flights along the East coast:

| Standard Season | Peak Season | |

|---|---|---|

| Route (UK to US) | Delta Main Cabin or Delta One | Delta Main Cabin or Delta One |

| East Coast US (Boston, New York JFK) | 15,000 points (Delta Main Cabin) or 47,500 points (Delta One) | 25,000 points (Delta Main Cabin) or 57,500 points (Delta One) |

| Central US (Atlanta, Detroit, Minneapolis | 17,500 points (Delta Main Cabin) or 47,500 points (Delta One) | 27,500 points (Delta Main Cabin) or 57,500 points (Delta One |

| West Coast US (Salt Lake City) | 20,000 points (Delta Main Cabin) or 67,500 points (Delta One) | 30,000 points (Delta Main Cabin) or 77,500 points (Delta One) |

| Route (UK to US) | |

|---|---|

| Standard Season | Delta Main Cabin or Delta One |

| Peak Season | Delta Main Cabin or Delta One |

| East Coast US (Boston, New York JFK) | |

| Standard Season | 15,000 points (Delta Main Cabin) or 47,500 points (Delta One) |

| Peak Season | 25,000 points (Delta Main Cabin) or 57,500 points (Delta One) |

| Central US (Atlanta, Detroit, Minneapolis | |

| Standard Season | 17,500 points (Delta Main Cabin) or 47,500 points (Delta One) |

| Peak Season | 27,500 points (Delta Main Cabin) or 57,500 points (Delta One |

| West Coast US (Salt Lake City) | |

| Standard Season | 20,000 points (Delta Main Cabin) or 67,500 points (Delta One) |

| Peak Season | 30,000 points (Delta Main Cabin) or 77,500 points (Delta One) |

Standard season: 04 January 2024 – 21 March 2024, 16 April 2024 – 15 June 2024, 03 September 2024 – 24 October 2024, 06 November 2024 – 06 December 2024.

Peak season: 01 January 2024 – 03 January 2024, 22 March 2024 – 15 April 2024, 16 June 2024 – 02 September 2024, 25 October 2024 – 05 November 2024, 07 December 2024 – 05 January 2025.

The caveat to all this, of course, is that you can’t just book any flight at any time using Virgin Points. Whether you’re booking a Virgin Atlantic flight from JFK to Heathrow or a China Eastern flight from San Francisco to Beijing, there may only be a limited number of seats on each flight available for awards redemption.

As a result, it’s generally a solid best practice to find a great deal on an award ticket first, and then transfer points from your credit card. Transfers are generally instantaneous, so you won’t have to endure FOMO while you’re waiting for your points to arrive on the Virgin Atlantic side.

Another great reason to refrain from a transfer is this: if you book your flight through your card issuer’s travel portal (e.g. Capital One Travel, Chase Travel), you may be able to cover the entire cost using points (minus taxes and fees). However, if you transfer your points to Flying Club, Virgin Atlantic may only let you cover part of your fare with points.

The takeaway

All things considered, transferring credit card points to Virgin Atlantic might be worth it if you already have an excellent redemption deal that you’re ready to pounce on. That’s especially true if your card issuer is offering a 30% transfer bonus or higher at the moment.

But until you have a deal lined up, it might be best to keep your points on the credit card card side – where they’re more flexible, redeemable for cash back in a pinch and can help you cover the full cost of a flight.

And for more tips and tricks on how to travel like a pirate (read: cheap and fun), check out our Beginner’s guide to travel rewards: How to travel with credit card points and miles.

Frequently asked questions

Is Virgin Atlantic a transfer partner with Chase?

Yes, you can transfer Chase Ultimate Rewards to Virgin Atlantic Flying Club if you have the Chase Sapphire Preferred, Sapphire Reserve or Ink Business Preferred Cards.

In fact, Chase has run promos in the past with transfer bonuses to Virgin Club – such as an extra 30% promo that ran from May 1 to June 15, 2024.

Can I transfer Capital One Miles to Virgin Atlantic?

Yes, you can transfer Capital One Miles to Virgin Atlantic at a 1:1 ratio.

Just be sure that you have a Capital One card that actually generates Miles instead of cash back. The former group comprises all five Venture-branded cards.

Can Virgin Atlantic miles (aka Virgin Points) be transferred?

Yes, but only to another Virgin Atlantic Flying Club/Virgin Red member. There’s also a flat fee of $15 per transfer.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

About the contributors

EDITORIAL DISCLOSURE: The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.