Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Marriott’s two cobranded consumer Amex cards are out with welcome offers so rich, you may want to switch to skim milk in your coffee. Now, new applicants who apply and are approved for either the Marriott Bonvoy Bevy™ American Express® Card and the Marriott Bonvoy Brilliant® American Express® Card cards between August 8 and October 2, 2024 can fatten up their Bonvoy accounts with these offers. Here’s what you need to know.

The Marriott Bonvoy Bevy card, which comes with an annual fee of $250, is now offering 155,000 Marriott Bonvoy points after spending $5,000 in eligible purchases within the first six months of card membership. The previous offer was 85,000 points after spending $5,000 within the first six months of card membership.

The Marriott Bonvoy Brilliant, which comes with an annual fee of $650, is now offering 185,000 Marriott Bonvoy points after spending $6,000 in eligible purchases within the first six months of card membership. The previous offer was 95,000 after spending $6,000 in eligible purchases within the first six months of card membership.

These new cardholder bonuses are the highest ever on each of the cards, and were last offered earlier this spring, but expired on May 1, 2024. Anyone seeking an instant status boost and a luxe getaway with the Marriott Bonvoy brand can benefit from either of these card offers. Here’s some examples of what you can do with one of these generous offers:

Book a five night stay for two people at the St. Regis in Doha, Qatar at the end of January 2025 for just 133,000 Bonvoy points. Bonvoy’s Stay for 5, Pay for 4 program means that if you book five consecutive nights with points, you’ll receive the lowest points-value night for free.

To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page.

To view rates and fees of the Marriott Bonvoy Bevy™ American Express® Card, see this page.

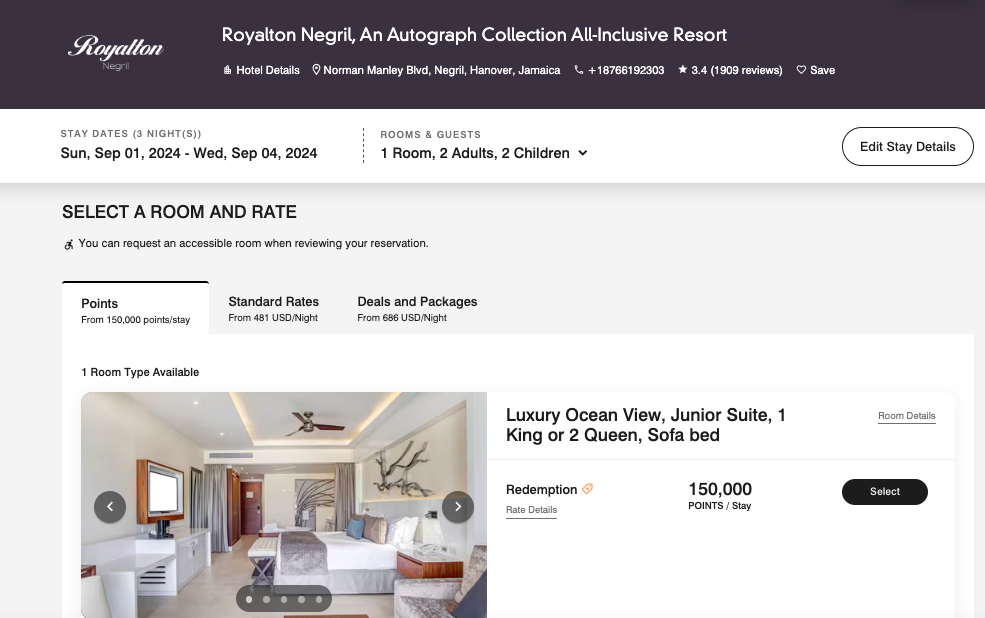

Or play hooky from work and school and make Labor Day weekend a four-day weekend for a family of four with a stay at the all-inclusive Royalton Negril in Jamaica for just 150,000 Bonvoy points, a steal when you consider that all meals and drinks are included.

Are the Marriott Amex cards worth it?

Aside from the welcome offers, both cards carry a number of valuable points-earning potential and other perks that can add even more value to your stays within the brand.

The Marriott Bonvoy Bevy card could be worth it for someone who finds the perks compensate for the annual fee, although at this price point, it’s disappointing it doesn’t offer a free annual hotel night. However, bigger spenders can likely get that from the card’s rewards structure of 6X points on eligible purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases in these two categories per calendar year, then 2X points), plus 2X points on other purchases.

The Bevy card also includes a 1,000 bonus points per stay credit, 15 Elite Night Status credits and the ability to earn one free night award, valid for up to 50,000 points after spending $15,000 in a calendar year. The included Gold Elite status also comes with additional perks including late checkout and room upgrades when available, free Wi-Fi, a welcome gift of points and more. To achieve Gold Status without the card requires 25 nights at a Marriott property.

Marriott Bonvoy Bevy™ American Express® Card

Intro Bonus

Earn 155,000 Marriott Bonvoy bonus points after you use your new card to make $5,000 in purchases within the first 6 months of card membership.| Annual fee | $250 |

| Regular APR | 20.99%–29.99% variable |

at Bankrate

Reward Rates

- 6xEarn 6 Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy

- 4xEarn 4X points at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases at restaurants and U.S. supermarkets per calendar year, then 2X points)

- 2x Earn 2X points on all other eligible purchases

- Additional benefits include secondary car rental loss and damage insurance, baggage insurance and trip delay Insurance

- Foreign transaction fee: None

at Bankrate

The Marriott Bonvoy Brilliant card is worth it for someone seeking to fast-track to the fat cat hotel life. The card earns 6X on Marriott spending, 3X on dining and flights and 2X on all other spending. It also offers some valuable benefits that can reduce the sting of the hefty annual fee, including a free night award each year after card renewal worth up to 85,000 points, an up to $300 dining credit (up to $25 per month in statement credits), cellphone protection, 25 Elite Night credits, Priority Pass Select membership, an up to $100 application fee credit for TSA Precheck or Global Entry and more.

The Brilliant card grants automatic Platinum Elite status which includes all of the benefits of Gold Elite but also gives a 50% points bonus on stays within the brand, guaranteed late checkout and an annual choice benefit after you reach 50 Elite Night Credits. The annual choice benefit options include five Nightly Upgrade Awards, gifting Silver Elite Status, adding five Elite Night Credits to your own account or donating to eligible charities.

Marriott Bonvoy Brilliant® American Express® Card

Intro Bonus

Earn 185,000 Marriott Bonvoy® bonus points after you use your new card to make $6,000 in purchases within the first 6 months of card membership.| Annual fee | $650 |

| Regular APR | 20.99%–29.99% variable |

at Bankrate

Reward Rates

- 6xEarn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy®

- 3xEarn 3X Marriott Bonvoy® points at restaurants worldwide

- 2x Earn 2X Marriott Bonvoy® points on all other eligible purchases

- $300 dining statement credit (up to $25 per month)

- $100 property credit for a minimum two-night stay at The Ritz-Carlton or St. Regis

- 1 free night every account anniversary

- 1 earned choice award after spending $60,000 in a calendar year

- $100 Global Entry/TSA Precheck application fee credit

- Complimentary Priority Pass Select to 1,200+ airport lounges for you and up to two guests

- Secondary car rental loss and damage Insurance, trip delay/cancellation/interruption insurance, baggage insurance

- Foreign transaction fee: None

at Bankrate

Our verdict? The welcome offers are so tempting, you might want to overindulge. But keep in mind that AmEx has a “once in a lifetime” rule, so if you’ve ever had one of these cards, you likely won’t be eligible for the welcome offer again. Additionally, if you’re recently held and scored a welcome bonus on another Marriott co-branded card, you may not be eligible for either of these offers. Fortunately, Amex will let you know if you’re not qualified for the bonus before your application is submitted. Read the fine print before you make your decision about applying.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

About the contributors

EDITORIAL DISCLOSURE: The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.