Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

The art of the travel credit card points transfer has an undeniable learning curve to it.

Think about it: If you just unlocked your welcome bonus with your Chase Sapphire Preferred® Card, you now have 14 transfer partners to consider when booking your next trip. Which partners are good for what?

That’s why Fortune Recommends™ has created a series where we break down each major transfer partner you may encounter with your Chase/Citi/Amex or other travel card, what they’re good for and how to find deals on the partner side so you know when to transfer points.

So let’s give a hearty bonjour to Air France-KLM’s Flying Blue!

What is Air France-KLM?

Flying Blue is the official loyalty rewards program of Air France-KLM, which itself represents a trio of European airlines:

- Air France – The flagship carrier for France, Air France is committed to “sharing French excellence with the world,” with French food and complimentary champagne in all cabins.

- KLM – Also known as Koninklijke Luchtvaart Maatschappij or Royal Dutch Airlines, KLM primarily serves to connect The Netherlands to the rest of the world. It’s also the oldest airline in the world still operating under its original, founding name – although it’s since been (thankfully) abbreviated.

- Transavia – A low-cost Dutch airline, Transavia is a bit like the “Spirit Airlines” of Europe, offering cheap, sub-Є100 flights to over 110 destinations across Western Europe, North Africa and the Mediterranean.

With their powers combined, Air France-KLM services up to 300 destinations in 120 countries. The group’s two main hubs are Paris-Charles de Gaulle and Amsterdam-Schiphol, so if you plan on trying the world’s most authentic baguette or running your hands through the tulip fields of Holland, chances are that you’ll be flying Air France-KLM in the near future.

For that reason, let’s dig deeper into what you can expect from the program.

How does Flying Blue work?

Flying Blue works a lot like other airline rewards programs. You can join for free right now, and start earning Miles for every Air France-KLM purchase you make. That includes tickets, upgrades, seating, even onboard French pastries.

You can also earn Miles on select flights with Air France-KLM’s 35 airline partners (including SkyTeam alliance partners), shopping with the group’s various retail partners and booking accommodations with its hotel and rental car partners including Hertz, Enterprise, Marriott, Hyatt and more.

If you’d like to see a complete list of ways to earn Flying Blue Miles, click here. But the rest of this piece is going to focus on answering one very simple question:

Is it worth transferring your credit card reward points to Flying Blue?

To find out, let’s start by confirming which cards are even capable of transferring points to Flying Blue in the first place—and make sure that yours is on the list.

Then, we’ll have a look at how much Flying Blue Miles are worth in terms of cash – and when it actually makes sense to transfer versus booking using cash or your credit card travel portal.

Finally, we’ll look at some of the best ways to redeem Flying Blue Miles, as well as where to find the best deals.

Which credit cards transfer to Flying Blue?

Here’s a list of credit cards card and card issuers that play ball with Air France-KLM. In each case, points transfer 1:1 to Flying Blue.

American Express

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card

- Amex EveryDay® Credit Card

- Amex EveryDay® Preferred Credit Card

- The Business Platinum Card® from American Express

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

To view rates and fees of the The Platinum Card® from American Express, see this page.

To view rates and fees of the American Express® Gold Card, see this page.

All information about the American Express® Green Card has been collected independently by Fortune Recommends™.

All information about the Amex EveryDay® Credit Card has been collected independently by Fortune Recommends™.

All information about the Amex EveryDay® Preferred Credit Cardhas been collected independently by Fortune Recommends™.

To view rates and fees of the The Business Platinum Card® from American Express, see this page.

To view rates and fees of the American Express® Business Gold Card, see this page.

To view rates and fees of the The Blue Business® Plus Credit Card from American Express, see this page.

The Platinum Card® from American Express

Intro bonus

Earn 80,000 Membership Rewards® Points after spending $8,000 on purchases on the Card in your first 6 months of card membership| Annual Fee | $695 |

| Purchase APR | See Pay Over Time APR |

| Foreign Transaction Fee | None |

at Bankrate

Reward Rates

- 5XEarn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (up to $500,000 on these purchases per calendar year)

- 5XEarn 5x Membership Rewards® Points on prepaid hotels booked with American Express Travel

- 1XEarn 1x points on other eligible purchases

Other benefits

- Travel benefits including hotel and car rental chain statuses, car rental insurance, trip cancellation/interruption and travel delay protection

- Consumer protections including extended warranty and return protection

at Bankrate

Bilt Rewards

Bilt Mastercard®

Special feature

The Bilt Mastercard offers the unique ability to earn points on rent.| Annual fee | $0 |

| Regular APR | See Terms |

at Bilt

Rewards Rates

- Make at least 5 transactions in a statement period, in order to earn points on rent and qualifying net purchases (purchases minus returns /credits) for that statement period.

- 3X3X Bilt Points on dining

- 2X2X Bilt Points on flights, hotels, rental cars, and cruises when booked directly with airlines, hotels, and car rental agencies

- 1X1X Bilt Points on rent paid through the Bilt App with your card account up to a maximum of 100,000 points each calendar year

- 1X1X Bilt Points on purchases

- Rewards and benefits terms.

- Travel perks: Trip Cancellation and Interruption Protection, Trip Delay Reimbursement, Auto Rental Collision Damage Waiver. See this page for details.

- Foreign Transaction Fee: None

at Bilt

Chase

Chase Sapphire Preferred® Card

Intro bonus

60,000 bonus points after $4,000 in purchases in your first 3 months from account opening. Plus, get up to $300 in statement credits on Chase Travel purchases within your first year.| Annual fee | $95 |

| Regular APR | 20.99%–27.99% variable |

Rewards Rates

- 5x5x points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit)

- 3x3x points on dining at restaurants, including takeout and eligible delivery services

- 2x2x points on travel purchases not booked through Chase

- 1x1x points on other purchases

- 5x5x points on Lyft rides through March 31, 2025 (that's 3x points in addition to the 2x points you already earn on travel)

Pros

- Valuable welcome bonus

- Extensive list of transfer partners

- Extra value on travel redemptions

Cons

- No premium travel perks

- Has an annual fee

-

- Additional perks: $50 annual hotel credit, trip cancelation/interruption insurance, auto rental collision damage waiver, complimentary Doordash and Instacart+ membership along with quarterly Instacart+ credits

-

- Foreign transaction fee: None

Capital One

- Capital One VentureOne Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Capital One Venture Rewards Credit Card

- Capital One Spark Miles

- Spark Miles Select

Capital One Venture X Rewards Credit Card

Intro bonus

Earn 75,000 bonus miles after spending $4,000 on purchases within the first 3 months from account opening| Annual Fee | $395 |

| Purchase APR | 19.99%–29.99% variable |

| Foreign Transaction Fee | None |

at Cardratings.com

Rewards Rates

- 10X 10X Miles per dollar on hotels and rental cars booked through Capital One Travel

- 5X 5X Miles per dollar on flights and vacation rentals booked through Capital One Travel

- 2X 2X Miles per dollar on every purchase, every day

Other benefits

- Travel protections including car rental insurance, trip cancellation/interruption and travel delay protection

- Consumer protections including extended warranty and return protection

at Cardratings.com

Citi

- Citi Premier® Card (no longer accepting applications)

- Citi Strata Premier℠ Card

- Citi Prestige (no longer accepting applications)

Citi Strata Premier℠ Card

Intro Bonus

75,000 bonus points after spending $4,000 in the first 3 months of account opening.| Annual Fee | $95 |

| APR | 21.24% to 29.24% variable |

Rewards Rates

- 10x10 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked through CitiTravel.com.

- 3x3x points per $1 on air travel and other hotel purchases.

- 3x3x points per $1 at restaurants.

- 3x3x points per $1 at supermarkets.

- 3x3x points per $1 at gas stations and EV charging stations.

- 1x1x point per $1 on all other purchases

Pros

- Strong earning rates on travel, dining, supermarkets and gas/EV charging

- Robust list of travel protections

- Points transfer 1:1 to most partners and 1:2 to Choice Privileges

Cons

- Hotel benefit only applies on a stay costing $500 or more

- Charges an annual fee

- Additional perks: Trip delay protection, trip cancellation and interruption protection, lost or damage luggage coverage, rental car insurance, $100 off a single hotel stay of $500 or more (excluding taxes and fees) booked through CitiTravel.com.

- Foreign transaction fee: None

Now, provided you see one of your cards on the list, should you even consider a transfer in the first place?

What are Flying Blue Miles worth?

Credit card nerds tend to agree that Flying Blue Miles are worth around 1.2 cents a pop. That said, miles are worth what they are worth to you.

Even though that’s higher than the average cash back value of a Chase or Citi point, don’t go transferring all of your points over just yet. First, there are a few things you should know about transfers to Air France-KLM, and point transfers in general.

For starters, transfers from credit card issuers to travel partners are typically one-way. You can’t move points from your Flying Blue account back into Chase, so you’ll want to time your transfers wisely.

Second, 1.2 cents per Flying Blue Mile is just an average. The redemption rate will vary by flight, date, destinations and seat location— so again, it’s best to find the exact flight you want first before shifting all of your hard-earned credit card points over.

So how do you find the best deals and “sweet spots” on Flying Blue?

How to find deals and sweet spots on Flying Blue

Luckily for you and me, Flying Blue makes finding deals on redemption flights very, very easy.

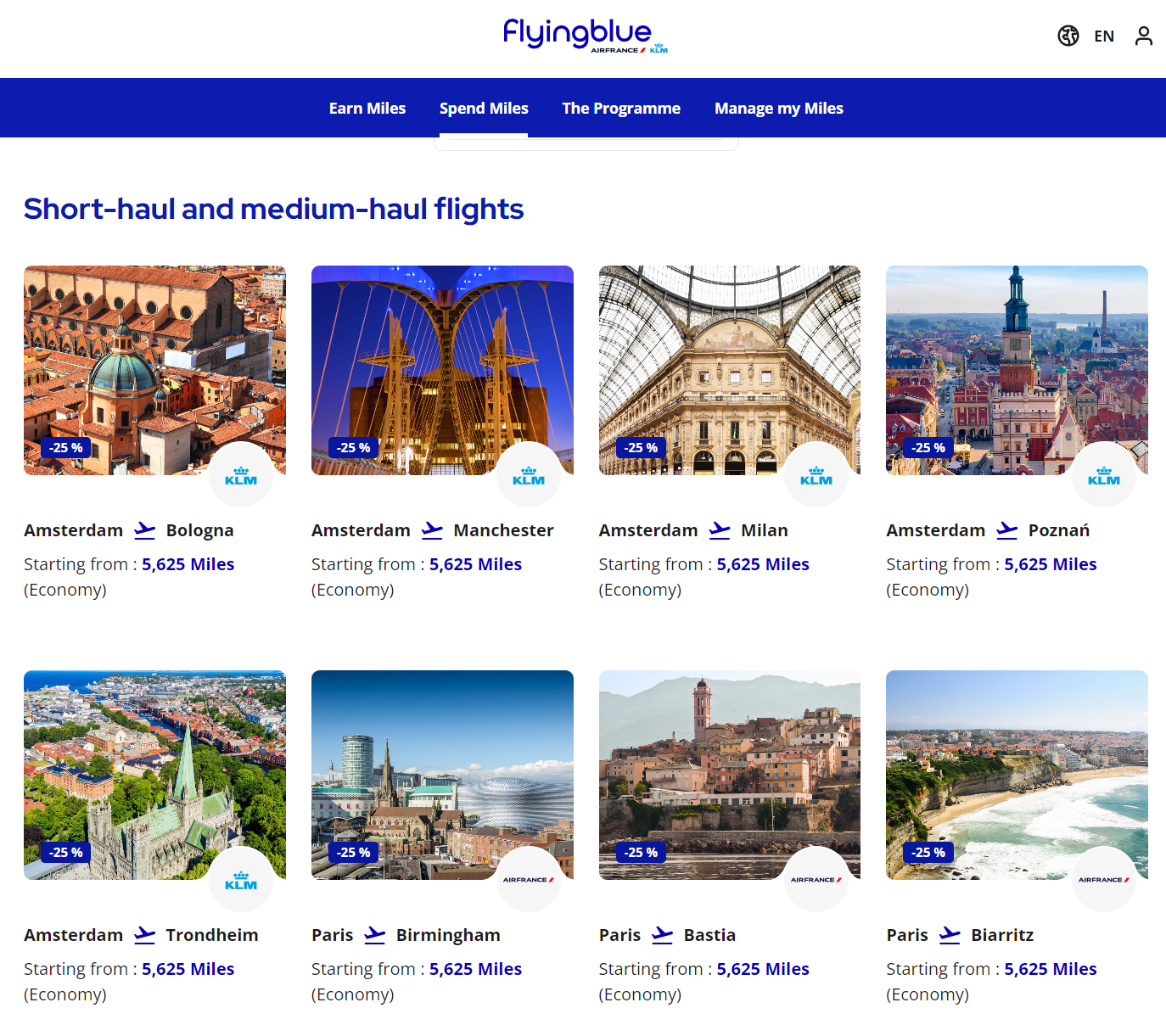

In fact, the program has a whole page dedicated to promo reward flights that change monthly, where you can nail deals on short- and long-haul flights up to 50% off their typical cost in Miles.

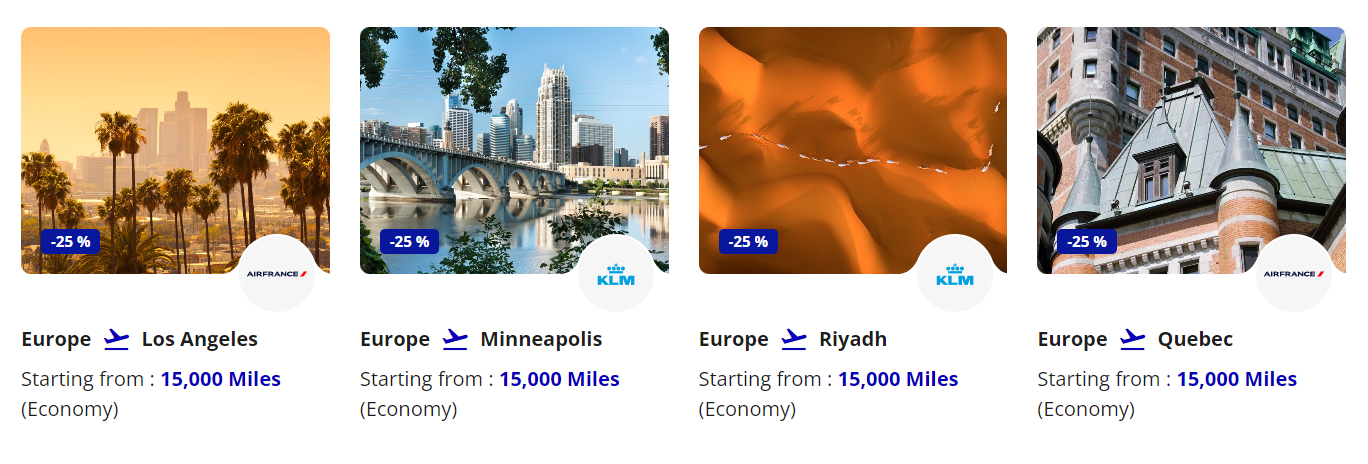

Prices are for one-way fares only and don’t include taxes and fees, but even still, there are absolutely some eye-popping deals to be found on this page. At the time of this writing, three of the biggest highlights are Europe <> Austin, Los Angeles or Minneapolis for a modest 15,000 Miles each way.

Air France-KLM posts new deals on the first weekday of each month, and the deals typically let you pick your travel dates up to six months out (e.g. deals posted July 1st, 2024 allow for travel dates until December 31st). You can also book deals for anyone, provided you yourself are a member of Flying Blue.

Once you spend the 15,000ish Miles to reach Europe from the U.S., promo deals within Europe are also ridiculously cheap, likely thanks to budget-minded routes from Transavia or another SkyTeam partner. As you can see from the screenshot above, once you land in Paris or Amsterdam, the world is your oyster – you can fly to Milan, Manchester or Nuremberg for just 5,625 Miles each ( at the time of this writing).

To put that all into context, let’s say you apply for the Chase Sapphire Preferred card and score your welcome bonus within the next three months. Depending on what the Air France-KLM promos look like in a few months’ time, that could easily be enough points to fly you and a companion to Europe and back – and you might even have points to spare to take a brief jaunt to the French coast or put a dent in your hotel bill.

The takeaway

In a nutshell, Air France-KLM Flying Blue is the transfer partner to keep in mind if you’re traveling to/from Europe, especially if you’re traveling within Europe itself. Heck, the redemption deals on its promo page are so good that they’re honestly worth checking when you’d just like to travel in general, since some of the international flights on there are cheaper than domestic flights back home.

And for more tips and tricks on traveling with minimal out-of-pocket costs, check out our Beginner’s guide to travel rewards: How to travel with credit card points and miles.

FAQs

Can you transfer Capital One points to Flying Blue?

Yes, but not all Capital One “points” can transfer to Flying Blue. Specifically, Capital One Miles generated by the Venture-branded cards are transferable.

Is Delta a member of Flying Blue?

Delta, Air France and KLM are all members of the Skyteam alliance of global airlines. Flying Blue is a loyalty rewards program specific to Air France, KLM and Transavia airlines.

Is Flying Blue a Chase partner?

Yes, Flying Blue is a transfer partner of Chase. If you have a Chase Sapphire Preferred, Sapphire Reserve or Ink Business Preferred card you can transfer Chase Ultimate Rewards points to Flying Blue at a 1:1 ratio (before applicable promos).

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

About the contributors

EDITORIAL DISCLOSURE: The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.